Bookkeeping is more than tracking numbers. It is a foundation for financial success. Whether you’re a small business owner or an individual managing personal finances, proper bookkeeping helps you save money over time. Accurate records reduce errors, ensure compliance, and provide clear financial insight. This leads to smarter decisions and long-term financial stability. In this blog, we’ll explore how bookkeeping saves money, helps you avoid costly mistakes, maximizes tax savings, and supports strong financial planning for the future.

The Basics of Bookkeeping

What is Bookkeeping?

Bookkeeping is the process of recording, organizing, and managing financial transactions. It forms the foundation of the accounting process by keeping records accurate and complete. Although bookkeeping and accounting are closely related, they are not the same. Bookkeeping focuses on daily financial entries and updates, while accounting analyzes and interprets that data for planning and decision-making.

The Core Functions of Bookkeeping

Bookkeeping serves several critical functions that keep your finances in check, including:

- Tracking Income and Expenses: Maintaining a clear record of where money comes from and where it’s spent.

- Recording Financial Transactions: Accurately logging every transaction, from small purchases to significant revenue streams.

- Maintaining Financial Records: Organizing data in a way that ensures easy access and compliance with legal and tax requirements.

Incorporating these basics into your routine is easier when adopting strategies like these practical tips for better bookkeeping, which streamline the process and save time.

How Bookkeeping Prevents Financial Losses

Minimizing Errors

One of the biggest ways bookkeeping saves money is by reducing errors in your financial records. Mistakes like missed invoices or incorrectly reported expenses can lead to overpayments or lost revenue. When you consistently record and review transactions, you can catch issues early and avoid expensive corrections later.

For example, comparing recorded income with bank statements ensures nothing is missed. This level of accuracy is especially important during tax season, where even small mistakes can lead to penalties.

Avoiding Penalties

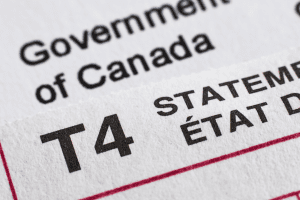

Late or inaccurate tax filings can lead to steep fines and interest charges. Bookkeeping ensures that your financial records are organized and up-to-date, making it easier to meet tax deadlines and fulfill compliance requirements. Staying on top of tax obligations not only saves money but also reduces stress during tax season.

Maximizing Tax Savings

Identifying Deductions

An organized bookkeeping system helps ensure you never miss eligible tax deductions. By tracking expenses accurately, you can identify deductible items like office supplies, travel, and business-related subscriptions. Missing these deductions can lead to overpaying taxes.

Detailed financial records also make it easier to support your deductions during an audit. Using bookkeeping software or professional services can help categorize expenses correctly and highlight areas for potential savings. Learning basic accounting concepts can also improve your ability to find and optimize deductions.

Streamlining Tax Preparation

Preparing taxes becomes much easier when your records are complete and organized. Good bookkeeping allows you to quickly gather the information needed to file accurate returns, saving both time and money. Whether you work with an accountant or file taxes yourself, having everything ready reduces the risk of errors, delays, and late submissions.

Improving Financial Planning

Enhanced Cash Flow Management

Effective bookkeeping supports strong cash flow management, which is essential for financial stability. By consistently tracking income and expenses, you get real-time insight into your cash flow. This helps you anticipate shortages and avoid overspending. For example, if you understand seasonal changes in revenue, you can plan for slower months without borrowing unnecessarily.

Maintaining cash flow visibility also supports timely bill payments and payroll management, reducing the risk of late fees and enhancing trust with vendors and employees.

Budget Creation and Adherence

Bookkeeping makes it easier to create realistic budgets based on accurate financial data. Well-maintained records of past transactions give you a solid foundation for forecasting future needs and setting achievable financial goals. By following these budgets, you can avoid overspending and use your resources more efficiently.

For small business owners, this approach helps you meet current obligations while still saving for growth opportunities or unexpected expenses. It reinforces long-term financial stability.

Long-Term Business Growth

Strategic Decision-Making

Bookkeeping offers valuable data that helps business owners make informed decisions. By reviewing trends in income and expenses, you can identify which areas of the business are profitable and where improvements are needed. For example, if records show that certain products consistently deliver higher margins, you can focus more resources on those offerings to increase profitability.

Accurate financial data also supports strategic planning. It helps you decide when to scale operations, invest in new opportunities, or adjust pricing strategies. Because these decisions are based on reliable records, they reduce financial risk and contribute to long-term, sustainable growth.

Building Investor and Lender Confidence

Transparent and accurate financial records are essential when seeking investments or loans. Lenders and investors often require detailed financial statements to assess the stability and potential of a business. Proper bookkeeping shows that you are in control of your finances and understand your business’s performance.

By keeping your records organized, you can quickly provide the documentation needed for funding applications. This makes the process smoother and increases your chances of approval. Clear financial information not only attracts investment, but also builds trust with stakeholders and supports long-term success.

Cost-Effectiveness of Professional Bookkeeping

DIY vs. Professional Services

While managing bookkeeping on your own may seem cost-effective at first, it often leads to missed details and mistakes that can become expensive over time. Professional bookkeeping services offer expertise and efficiency, ensuring your records are accurate and compliant. A professional can also identify savings opportunities and help optimize your overall financial management strategy.

For small businesses, outsourcing bookkeeping can save valuable time. It allows you to focus on growth and operations instead of getting stuck in financial record-keeping. This combination of expertise and time efficiency reduces stress and increases profitability.

Time Savings

One of the biggest advantages of professional bookkeeping is the time saved on routine financial tasks. Bookkeeping requires careful attention to detail, from tracking expenses to preparing financial reports. Professionals manage these responsibilities efficiently, allowing you to spend more time on the most important parts of your business.

The time saved can turn into better client service, more business development, or improved work-life balance. Over time, this efficiency increases the value of professional bookkeeping and proves it to be a smart investment for long-term financial success.

Real-Life Examples

Success Stories

Many businesses see significant financial benefits from effective bookkeeping. For example, a small retail shop struggling with cash flow used detailed financial records to identify seasonal trends. By adjusting inventory orders and planning for slower months, the owner stabilized cash flow and saved thousands of dollars each year.

Another example is a freelance professional who used organized records to identify tax deductions for home office expenses, mileage, and equipment purchases. These deductions resulted in significant savings and showed the value of detailed bookkeeping.

Lessons Learned

On the other hand, poor bookkeeping has caused financial challenges for many businesses. For example, a growing e-commerce company failed to reconcile its accounts regularly, which led to missed payments and vendor penalties. After implementing a reliable bookkeeping system, the business resolved these issues and repaired relationships with suppliers.

These examples highlight the importance of staying proactive with financial management and using bookkeeping as a tool to prevent and resolve challenges.

Tips for Effective Bookkeeping

Best Practices

- Consistency: Update records regularly to avoid falling behind.

- Leverage Technology: Use accounting software to automate repetitive tasks and minimize errors.

- Separate Finances: Keep personal and business finances distinct for clearer records and easier tax preparation.

When to Seek Professional Help

- If financial tasks are taking time away from core business activities.

- When facing complex tax or compliance requirements.

- If errors or discrepancies in records become frequent.

Hiring a professional bookkeeper can streamline operations and provide peace of mind, ensuring that your financial records are in expert hands.

Conclusion

Bookkeeping is an investment in long-term financial health. By maintaining accurate and organized records, you can prevent losses, maximize tax savings, and plan effectively for the future. Whether you manage bookkeeping yourself or hire a professional, the benefits far outweigh the costs, making it a cornerstone of financial success.

FAQs

- How often should I update my bookkeeping records? Ideally, update your records weekly to ensure accuracy and stay on top of your finances.

- Can bookkeeping help me avoid an audit? While it doesn’t prevent audits, accurate bookkeeping ensures you’re prepared and compliant, reducing the likelihood of penalties.

- What tools are best for small business bookkeeping? Tools like QuickBooks, Xero, and Wave are popular for their ease of use and robust features.

- Is hiring a professional bookkeeper worth the cost? Yes, especially for businesses with complex financial needs, as it saves time and reduces errors.

- How does bookkeeping impact my personal finances? Bookkeeping helps track spending, budget effectively, and prepare for taxes, improving overall financial management.